A Closer Look: The U.S. Economy - Borrowed Time or Sustainable Strength? A Look at Consumer Debt

by Haley Sienkiewicz, ITR Economics

Overall, consumers are managing debt effectively, a positive sign for future spending

Well-positioned consumers are driving growth in the macroeconomy, supported by mildly rising real incomes. US Total Retail Sales are rising, and consumer delinquency rates are generally on par with historical averages. Some isolated areas of weakness — notably, elevated auto loan delinquencies — are balanced by some stronger areas such as low mortgage delinquencies. At present, though, consumer metrics are signaling relative stability, which we expect will persist.

A central pillar of household finances is debt. US Total Household Debt has been rising for the past dozen years, mounting higher each year. Households rely on debt to fund necessities and everyday expenses, which generally rise in cost. Consumer Prices have risen a cumulative 26% since the end of 2019. This alone, however, is not cause for concern, as real incomes have risen to support debt-funded spending.

One metric for consumer health that factors into rising incomes is the debt-to-income ratio. In September, US Household Debt per Capita as a Percentage of US Median Annual Earnings was 107.0%. This metric is well within recent precedents, signaling that households are well positioned to weather economic swings. This resilience will vary by income bracket, however, with upper middle- to upper-income households being relatively more agile than their low- to middle-income counterparts.

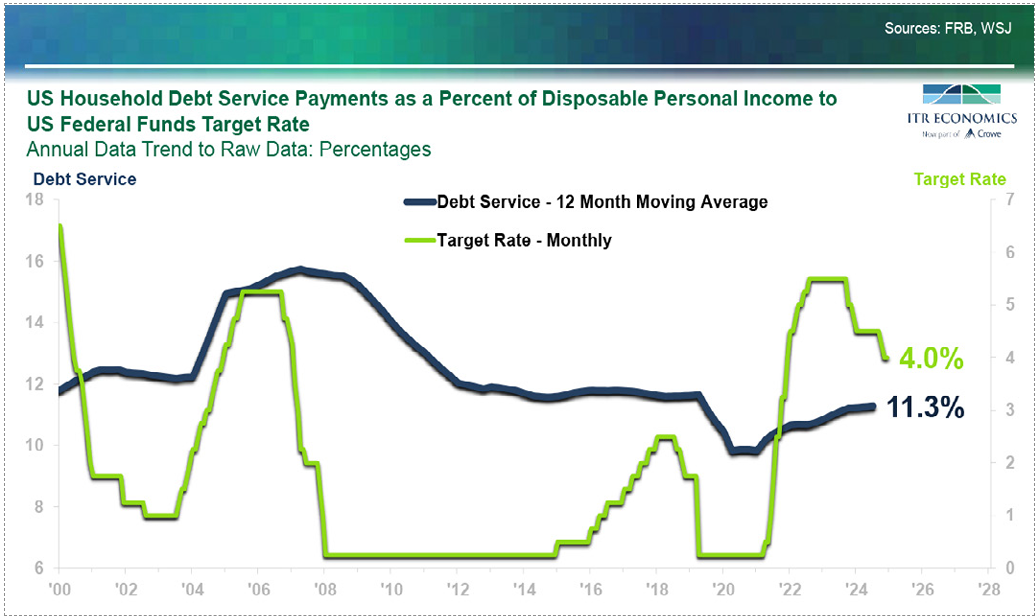

It is important to factor in fluctuations in borrowing costs. While rising incomes have helped offset higher debt levels, it is worth considering how much strain elevated interest rates have placed on household balance sheets in recent years. The answer: not as much as you might think. The high-level metric of US Household Debt Service Payments as a Percent of Disposable Personal Income, coming in at 11.3%, is trending below preCOVID levels despite interest rates being higher.

This percentage reached near-record lows in 2021 amid disruptions from the pandemic, stimulus checks, and low interest rates, but has since risen. Despite sloping upward, US Household Debt Service Payments as a Percent of Disposable Personal Income have been trending below pre-pandemic levels, a positive sign that, in aggregate, consumers are managing their debts well amid the high interest rate environment, an encouraging bellwether for future economic growth.

While aggregate conditions are stable, sensitivity to pricing, financing terms, and value proposition is likely to rise, particularly among lower- and middle-income customers. Focus your strategy on affordability, flexible payment options, and clear value differentiation to sustain demand during the upcoming period of mild economic growth.

READ NOW

|