Tariffs and HTS Codes: A Practical Guide for Nonferrous Foundries

Many nonferrous foundries do not think of themselves as importers or exporters. You may pour castings for a domestic customer, ship them to a nearby machine shop, and never see an international invoice. Even so, tariffs and HTS codes can still affect your business—often in ways that are not obvious until a customer asks a question or a price suddenly changes.

Many nonferrous foundries do not think of themselves as importers or exporters. You may pour castings for a domestic customer, ship them to a nearby machine shop, and never see an international invoice. Even so, tariffs and HTS codes can still affect your business—often in ways that are not obvious until a customer asks a question or a price suddenly changes.

Understanding the basics can help you respond confidently to customers, avoid costly mistakes, and identify opportunities when trade policies shift.

What Is an HTS Code?

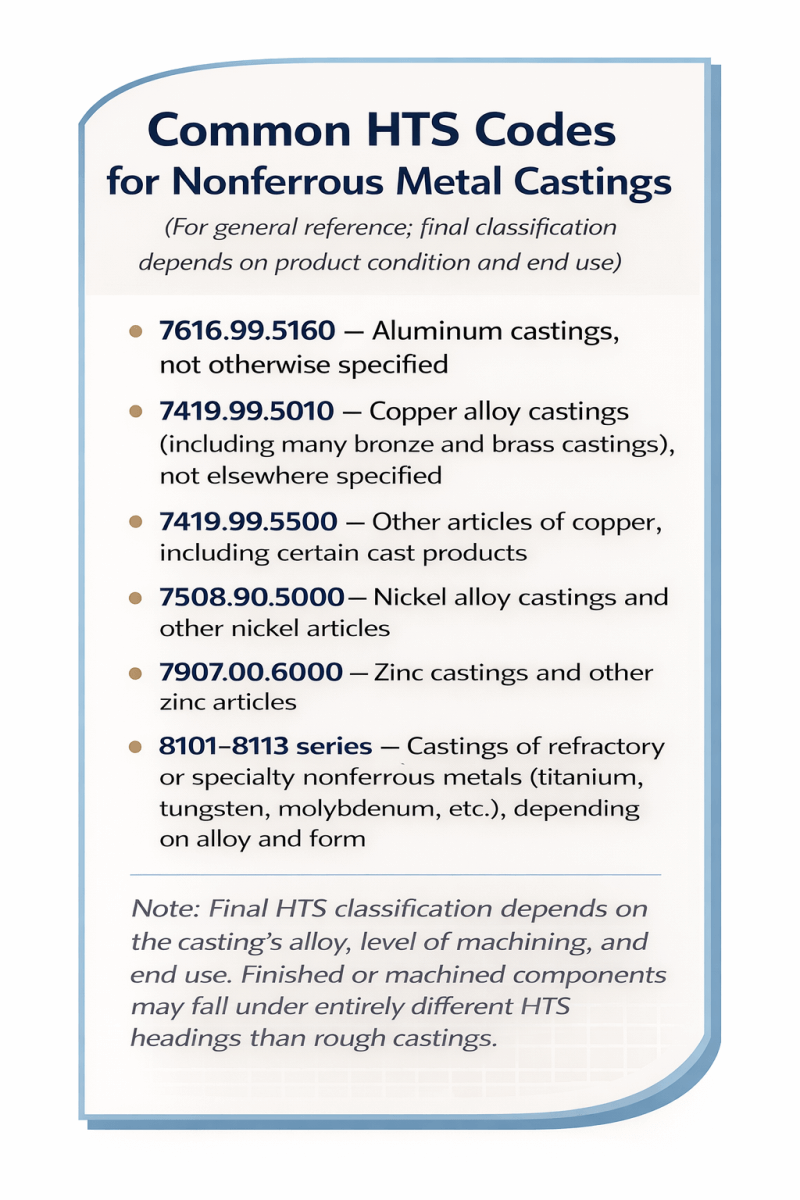

The Harmonized Tariff Schedule (HTS) is the system the United States uses to classify imported goods. Every product that crosses the border is assigned a numerical code that describes what it is. That code determines the tariff rate, if any, that applies to the product.

For nonferrous foundries, most raw castings fall under HTS Chapter 76 for aluminum or Chapter 74 for copper-based products. A common example is HTS 7616.99.5160, which covers many types of aluminum castings not specified elsewhere.

However, the correct classification depends on the condition of the casting and its intended use. A rough casting, a machined component, and a finished assembly may all fall under different HTS codes—even if they started from the same mold.

Why HTS Codes Matter to Foundries

Even if your foundry is not importing parts, tariffs can still affect you in several ways:

-

Customer pricing: If your customer imports a competing casting, tariffs may increase their costs and make your domestic product more competitive.

-

Supply chain costs: Tariffs on ingot, alloying elements, or components can increase your raw material or equipment costs.

-

Contract requirements: Government or defense contracts often require suppliers to understand HTS classifications and country-of-origin rules.

-

Customer questions: More OEMs are asking their suppliers to confirm HTS codes and tariff exposure as part of sourcing decisions.

Being able to provide a clear, accurate answer builds credibility and avoids delays.

What “Inclusions” and “Exclusions” Mean

When the U.S. government imposes tariffs—such as those under Section 232 or Section 301—it usually applies them to a specific list of HTS codes. If your product’s HTS code appears on that list, it is considered “included” in the tariff action and subject to the additional duty.

An exclusion is a formal request to remove a specific product from the tariff, even though its HTS code is on the covered list. Exclusions are typically granted when:

-

The product is not available from U.S. sources,

-

The tariff would cause severe economic harm, or

-

The item has national security or supply chain importance.

Exclusions are not automatic. They require a formal application, detailed product descriptions, and supporting evidence. If granted, the exclusion may apply to one company or, in some cases, to all importers of that specific product.

How the Exclusion Process Works

While each tariff program is slightly different, most follow a similar structure:

-

Tariff announced: Government identifies HTS codes subject to additional duties.

-

Exclusion window opens: Companies can apply for product-specific exclusions.

-

Review process: Government agencies review requests and public comments.

-

Decision issued: Exclusion is granted, denied, or modified.

-

Retroactive relief (if applicable): Some exclusions allow for tariff refunds on past imports.

The key point is that exclusions are very specific. They are based on exact product descriptions, dimensions, alloys, and end uses—not just the general HTS code.

Practical Tips for Foundries

You do not need to be a trade lawyer to manage this issue effectively. A few practical steps can go a long way:

-

Know your basic HTS classifications for your primary casting types.

-

Coordinate with your customers if they are importing similar products.

-

Keep product descriptions clear and consistent across quotes, invoices, and specifications.

-

Consult a customs broker or trade specialist if a classification is uncertain.

-

Monitor tariff announcements that may affect your alloys or product lines.

For foundries working in defense, heavy industry, or export markets, these issues are becoming more common. Being prepared can help you respond quickly to new opportunities or disruptions.

The Bottom Line

HTS codes and tariffs are no longer just an issue for large importers. Trade actions increasingly affect raw materials, cast components, and the customers you serve. A basic understanding of how classifications, inclusions, and exclusions work will help your foundry stay competitive and informed.

NFFS will continue to monitor tariff developments affecting nonferrous castings and provide guidance to members as policies evolve. If you have questions about a specific product or classification issue, please reach out to the NFFS office for assistance.