|

A Closer Look: The U.S. Economy – Commercial Real Estate

by Michelle Kocses, ITR Economics

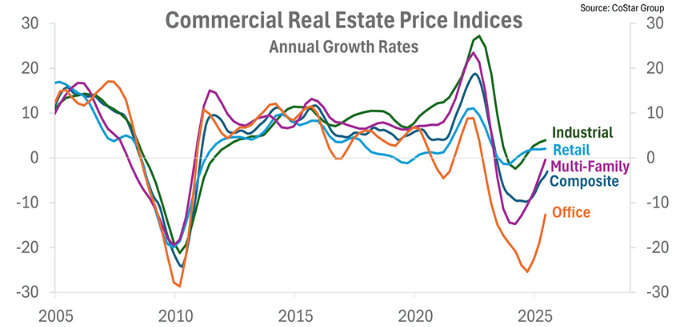

What you need to know: While the commercial real estate market is stressed, a recovery trend in Prices is already underway.

The prior jump in interest rates and soft economic activity last year are weighing on new commercial construction, pulling it down double-digit percentages below year-ago levels. But how is the existing commercial real estate market holding up? CoStar’s US Composite Commercial Real Estate Price Index declined 16.7% from late 2022 into mid-2025 on an annual average basis, but Prices are now in a recovery trend. Office Prices, down 43.4% from a mid-2022 peak, are dragging down the whole. Remote work, the expansion of AI, and weak white-collar employment have made the expense of an office building less appealing. This is a structural problem that is likely to persist. Annual average Multi-Family Prices are beginning to rebound and are just shy of year-ago levels. Meanwhile, Retail Prices and Industrial Prices are above year-ago levels and accelerating as they rise.

Lower Prices, though concentrated in offices, pose an increased risk that some businesses may be underwater on their loans. The annual average US Delinquency Rate on Commercial Real Estate Loans stands at 1.6% as of June 2025 and has been rising since late 2022. While rising delinquency is concerning, the rate is still within the typical range for noneventful times. For comparison, during the early 1990s and Great Recession real estate crises, Delinquency Rates rose above 11.7% and 8.7%, respectively. Corporate financials, with near-record profits, are in a fairly good position, which limits the risk of runaway delinquency. Recent acceleration in consumer and B2B spending illustrates improving economic conditions. Margins, and therefore profits, could come under pressure as inflation picks up, but in aggregate, businesses will be supported by mild improvement in underlying volume.

US Commercial Real Estate Loans spiked in 2022 and 2023, with year-over-year growth peaking at 11.4%. Five-year loans made in the early 2020s will be due soon, often with balloon payments rolled over into new loans. However, today’s higher rates mean refinancing will come with higher interest expenses. While higher interest costs are not desirable, the recovery trend in Commercial Real Estate Prices and solid corporate finances suggest the commercial real estate market has the means to weather the higher expense load. We are monitoring this closely.

The Federal Reserve’s cut to overnight rates is a welcome shift for many, but do not expect a one-to-one reduction in interest rates on commercial real estate loans. These are much longer in duration and factor in risks such as property valuation trends, the creditworthiness of the borrower, and inflation projections. As such, longer-term interest rates are stickier than the Federal Reserve’s overnight rate.

While there are some weak spots in the commercial real estate market, particularly in the office market, the macroeconomic backdrop is helping provide some relative relief, with Prices recovery underway. Nonetheless, we suggest our clients keep a close eye on their exposure to commercial real estate. Our concerns are centered on the second half of this decade as interest rates rise, the US government’s deficit problems come to a head, and cumulative inflation causes a drag on the economy. Ask yourself: what geographic areas (desirable, with net population inflows, or not) are you exposed to? Which asset classes are you exposed to? Office and industrial vacancies are notably higher than multi-family or retail. As we move closer to the 2030s, risks increase, and so should the level of scrutiny you apply to your CRE portfolio.

|