Overtime Payroll Tax Changes: What Employers Need to Know

Congress recently enacted a new federal tax package that includes several provisions affecting employee compensation, particularly overtime and tipped income. While most NFFS member foundries are not tip-based workplaces, the overtime provisions may be relevant for nearly every employer in our industry.

Congress recently enacted a new federal tax package that includes several provisions affecting employee compensation, particularly overtime and tipped income. While most NFFS member foundries are not tip-based workplaces, the overtime provisions may be relevant for nearly every employer in our industry.

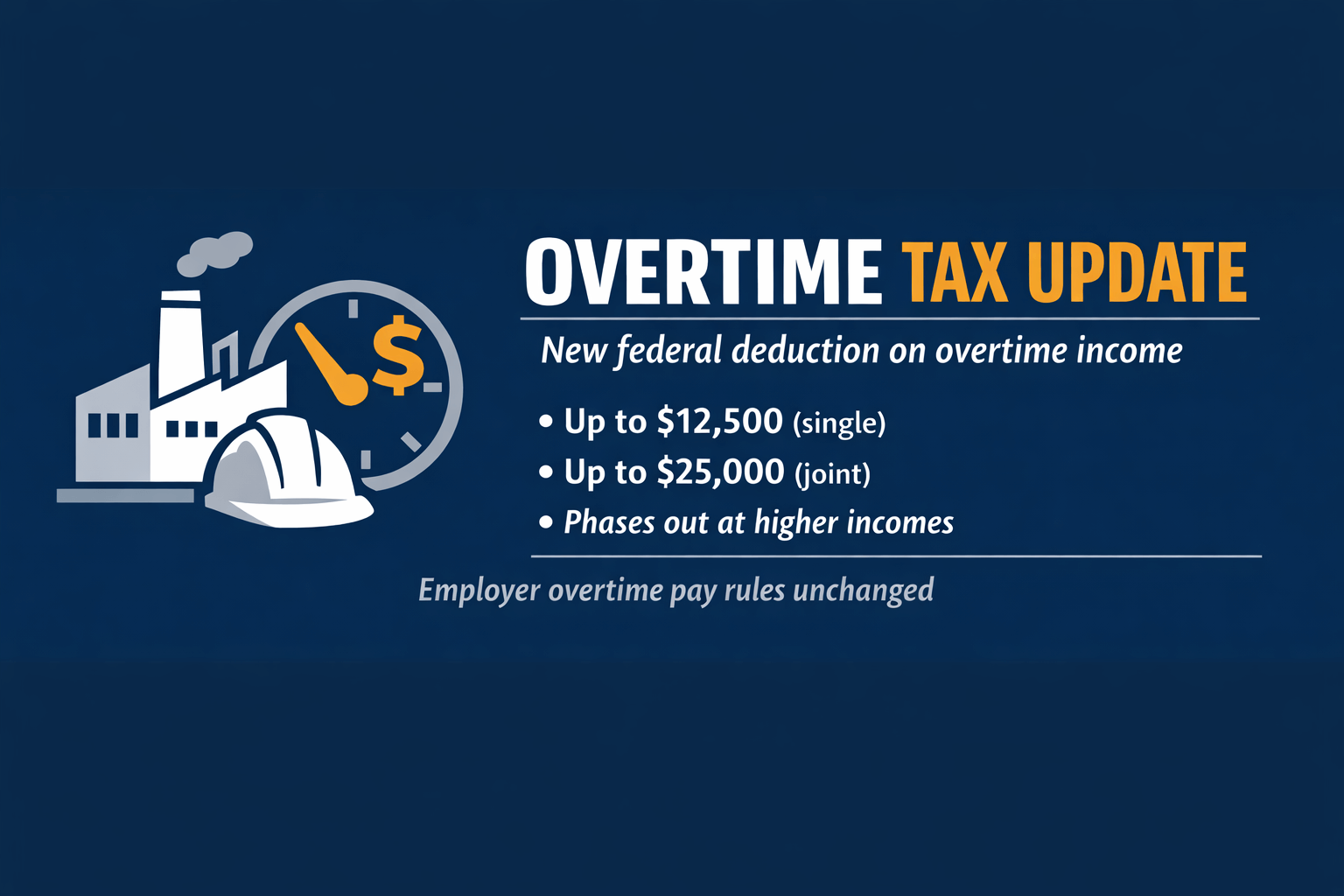

Under the new law, employees may claim a federal income-tax deduction on a portion of their overtime earnings. The deduction is capped at $12,500 per year for individual filers and $25,000 for joint filers, and begins to phase out at $150,000 in income ($300,000 for joint filers). This change does not eliminate overtime pay requirements, nor does it reduce the employer’s payroll tax obligations. Employers must still calculate, report, and pay overtime wages in full compliance with federal and state wage-and-hour laws.

For employers, the primary impact is administrative. Payroll systems, W-2 reporting, and employee communications may need to be updated to reflect the new tax treatment of overtime and any related tip provisions where applicable. While the deduction benefits employees at tax time, it does not change how overtime is calculated or paid through the payroll process.

NFFS recommends that member companies review these changes with their payroll providers or tax advisors to ensure systems and employee communications are aligned with the new law. Additional guidance and technical clarifications are expected as the IRS issues implementing rules.